The Overview

in-vest

To expend money with the expectation of achieving a profit or material result by putting it into financial schemes, shares, or property, or by using it to develop a commercial venture.

Being a full time real estate investor, I frequently have people ask if they can “pick my brain” about aspects of investing in real estate. In this article I will outline the basics. At its core, real estate investment is the art of expending money, in the pursuit of turning it into more money.

If you’re an average Joe or a “Mom and Pop” type investor like myself, there are two main ways to make money in tangible real estate investments: Cash Flow and Speculation.

Cash Flow

Cash Flow is the principle of the income a property generates, being GREATER than the expenses incurred, in owning said property. In other words, the money coming in needs to be greater than the money going out and if its not… you’re going to have a bad time.

Let’s take, for example, the most basic of real estate investments; the single family detached home rental. As I am writing this, the median home price in my community of Santa Rosa, CA, is $541,700.

| Purchase Price |

$541,700.00 |

| Down Payment (20%) |

$108,340.00 |

| Gross Rent |

$3,000.00 |

| LESS: Mortgage Payment |

-$2,326.00 |

| LESS: Insurance (Monthly) |

-$80.00 |

| LESS: Property Tax (Monthly) |

-$564.00 |

| Total Cash Flow (Monthly) |

$30.00 |

As you can see, this property will not perform well as a rental from a cash flow standpoint. Here’s why: $30 per month in positive cash flow is negligible, within the margin of error, and your total cash flow for the year could easily be washed out by a single unforeseen repair or expense. This is common in areas with high home purchase prices. The higher the mortgage payment, the greater the interest expense that is offsetting and eroding the rent you are receiving. However, that does not mean there isn’t money to be made in expensive markets, it is just in the form of speculation as opposed to cash flow.

Speculation

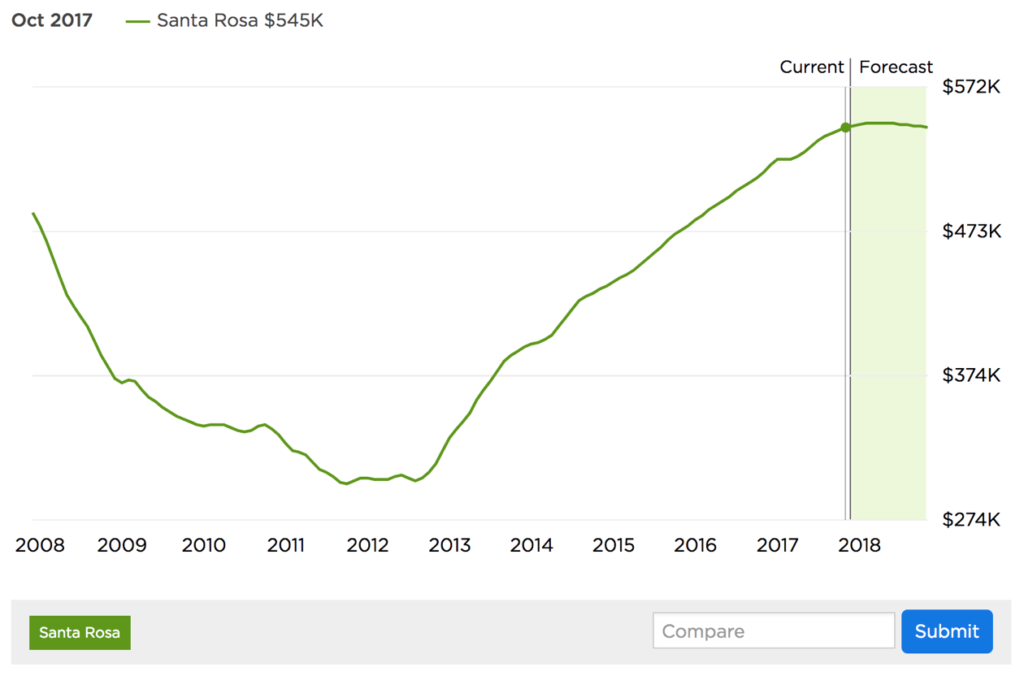

Real estate speculation is the investment in a property today in the hopes that it will be worth more at a point in the future. While cash flow can be stingy in pricey markets, appreciation has been abundant. Here below is a graph showing home values over time:

The zillow.com home value index for July 2012 in Santa Rosa was $301,000. In Oct 2017 it had jumped to $545,000. According to these values, if you would have bought a home in 2012 and sold it in 2017 you would have a gross profit of $244,000. Assuming you put 20% down on the property at the time of purchase, this gain represents a whopping 405% return on your investment. Take that total return and annualize it over the 6 year hold period, and you are looking at a 67.5% annualized return on your down payment. Given your down payment represents your total cash investment, that figure also represents your cash on cash return. Not too shabby…

Cash flow and speculation are two examples used to exemplify these two principles of investing, but its important to note that lots of properties do work great from a cash flow standpoint, and that real estate values fluctuate both up and down. Every real estate market is unique and different, and the overall local and world economies and financial markets play a major role in what real estate asset prices do. That is why it is recommended to take the time to educate yourself, start following and honing in on a specific market, and then acting when a great opportunity presents itself. At the end of the day, the goal is to achieve both positive cash flow and positive return on investment (speculation).

Author ~ Mark Vieira, President @ Vieira Investments, Inc.

Connect: Facebook | Insta @viincorp